Murkowski: End of the Year Package Could Have Big Impacts on Alaska

Legislation Includes Wide Ranging Tax Relief, Policy Provisions, and Funding Proposals

Congress has reached an agreement on a year-end spending and tax package that sets federal funding levels for the next year and extends a series of tax breaks. Senator Lisa Murkowski (R-AK), as a senior member of the Senate Appropriations Committee, had a major role in crafting the final package. The spending bill sustains Alaska’s contribution to national defense, funds the delivery of the benefits that our veterans have earned, protects our fisheries, and fulfills the federal government’s commitments to Alaska Natives. Alaskans will also enjoy tax relief as the legislation temporarily delays the implementation the “Cadillac Tax,” one of the Affordable Care Act’s more costly provisions. The bill also halts any new funding for the Environmental Protection Agency and prevents continued overreach.

Both the House of Representatives and the U.S. Senate are expected to vote on the legislation this week.

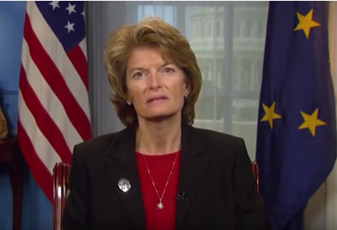

(Senator Murkowski discusses the spending bill—Click image to watch video)

Fisheries: Major wins for Alaska’s seafood industry are included, such as:

- GE Salmon: Senator Murkowski made major successful strides fighting against “Frankenfish” by securing language to block the Food and Drug Administration (FDA) from introducing genetically engineered salmon into the market until it publishes labeling guidelines so consumers are aware of what’s contained in the product they’re purchasing. Further, Murkowski directed the FDA to develop labeling guidelines and implement a program to inform consumers whether or not the salmon for sale is genetically engineered. This comes on the heels of the FDA approving the production and sale of genetically engineered salmon last month.

- Pollock Nomenclature: Senator Murkowski also included a provision that allows only pollock caught in Alaskan waters and U.S. waters out to 200 nautical miles to be marketed as “Alaska Pollock”. This change will prevent any future low-quality Russian pollock to be falsely marketed as “Alaska” in U.S. stores nationwide.

- J-1 Visas: Murkowski secured a provision supporting the J-1 Visa program through the next fiscal year, to help many of Alaska’s seafood processors who struggle to fill large numbers of seasonal jobs locally, in-state, or domestically due to a lack of applicants.

- H-2B Visas: Additionally, Murkowski was able to secure language to provide additional resources for the prompt processing of foreign labor certificates for the H-2B Visa program, and require the agency look at how the current program affects the hire of seasonal workers in Alaska’s fisheries and tourism industries. The provision also blocks the most controversial portions of the Department of Labor’s new H-2B Visa Program and wage regulations.

Defense: Alaskan military bases benefit in the following ways:

- The bill provides strong funding for the nation’s ground base midcourse interceptors at Fort Greely, research and development money for improvements to the interceptors, and requests funding to support development of the Long Range Discrimination Radar to be built at Clear Air Force Station.

- The bill supports military construction projects in Alaska:

- $37 million for a new F-35 simulator building at Eielson Air Force Base in anticipation of the F-35s coming to Alaska,

- $34.4 million for improvements to the Eielson Air Force Base Central Heat and Power Plant,

- $7.8 million for a long-awaited physical training facility at Fort Greely.

- Senator Murkowski secured a $5 million increase in the Defense Department’s Innovative Readiness Training Program, through which military reservists construct infrastructure and provide healthcare in remote parts of Alaska to fulfill their annual training requirements.

- Senator Murkowski secured another $2.5 million for research and development into new Arctic camouflage to support US Army Alaska.

- Murkowski also helped to secure an additional $10.5 million to support the lifesaving work of Civil Air Patrol squadrons in Alaska and throughout the nation.

Support for Veterans: Senator Murkowski laid the groundwork for major reforms to the nationwide Veterans Choice Program which has frustrated veterans in Alaska and across the nation. Murkowski has two amendments in the bill, one of which requires the Government Accountability Office to independently assess why the Choice Program is failing veterans, both in Alaska and around the country. The other amendment requires that the VA report to Congress on its plans going forward for providing healthcare to Alaska veterans in their home communities when the VA cannot provide it in their own facilities.

Alaska Native Programs: Senator Murkowski secured a provision to fully fund contract support costs—the operational costs of tribes to deliver federal Indian programs. This provision also creates a separate appropriations account to protect other Indian programs from having to pay for contract support cost shortfalls. The bill also provides an additional $25 million for the Bureau of Indian Affairs with important increases to programs that help combat domestic violence, substance abuse, and other public safety initiatives which includes $10 million in Tribal Court funding for P.L. 280 states such as Alaska.

Making the EPA Work in Alaska: The bill ensures that the EPA continues operating the backhaul program for five years to remove solid waste and garbage from communities in rural Alaska.

Tax Relief: Included in the spending and tax bills are a series of tax relief provisions:

- Cadillac Tax: The implementation of the Affordable Care Act’s “Cadillac tax” will be delayed for two years. This tax on high-cost insurance plans hits Alaska harder than anywhere else in the nation, simply because health care is more expensive in a rural, low population state.

- Medical Device Tax: The ACA-mandated tax on medical devices on pacemakers, joint replacements, defibrillators, and other items will be delayed for two years as well.

- Small Business Expensing: Increases the expensing limit from $200,000 to $500,000, provides indexing over time and extends the provisions out for two years. Rather than a year-end retroactive fix, this allows our construction and heavy equipment companies across the state to plan for large purchases rather than hedge at the end of the year.

- Conservation Easement Reform: Contributions of land into conservation easements are now allowable charitable contributions. This will benefit Alaska Native Corporations across the state.